Group-wide Impact Management

The strategic primary objective of KfW Group is to transform the economy and society with the aim of improving economic, environmental and social living conditions. In order to achieve this, KfW, as one of the world’s largest promotional banks, promotes and finances investments by state governments, municipalities, the private sector (businesses), financial institutions and private individuals in Germany, Europe and around the world.

It is a key concern for KfW to capture the contribution of its co-financed customers and partner activities to sustainable development even more systematically, make it measurable and present it transparently for the entire group.

For this reason, KfW has been introducing a group-wide ‘impact management’ system within the framework of the strategic KfW projects ‘Roadmap Sustainable Finance’ and ‘tranSForm’ since 2020. At the core of this impact management system are measurable and comparable impact indicators.

With its indicators, the impact management system covers all three dimensions of sustainability (economic, environmental and social) and is guided by the 2030 Agenda of the United Nations with its 17 Sustainable Development Goals (SDGs).

KfW-wide Impact understanding

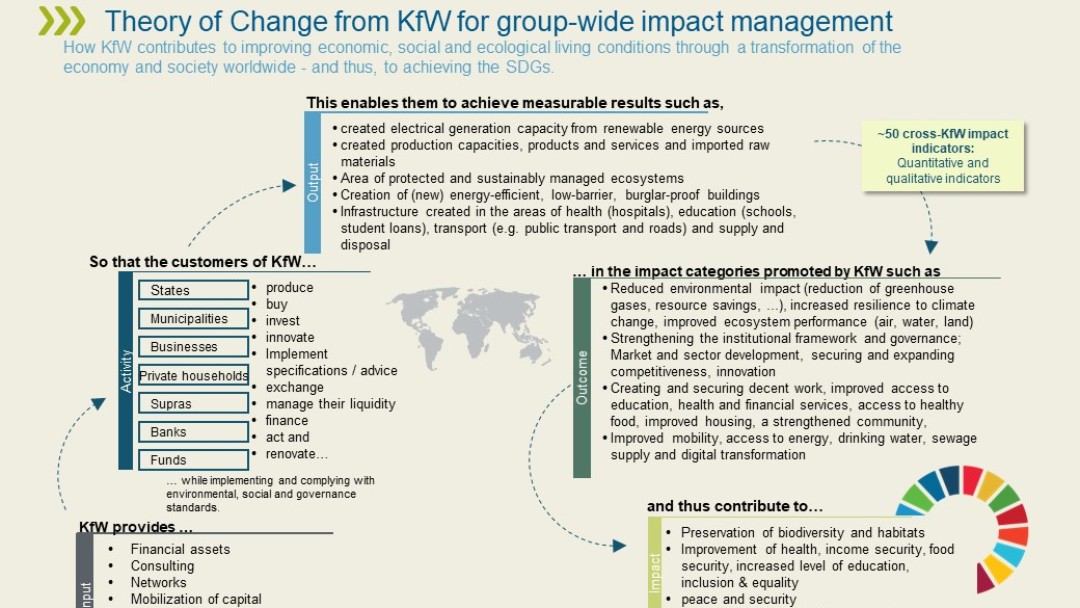

KfW’s understanding of impact with respect to sustainable development is derived from a theoretical impact model known as ‘theory of change’. The fundamental idea of a theory of change is to describe the process of an intervention from the means deployed up to the intended change and from there to develop corresponding areas of impact and indicators.

Accordingly, the theory of change established by KfW describes the correlations between the KfW funds deployed (input), the customer and partner activities co-financed with these funds (activity), their results (output) and the intended development effects (outcome) and, finally, the improvement to the economic, ecological and social living conditions (impact) including the impact indicators derived from them (see also Figure 1):

KfW-wide impact categories

In the context of this ‘Theory of Change’, key strategic impact categories were also defined (see Figure) to which KfW contributes or would like to contribute to improve living conditions around the world. Defining the impact categories gives structure to KfW Group’s wide-ranging promotional activities, allowing them to be systematically measured and efficiently managed. KfW’s impact categories cover (in line with KfW’s mission as a transformative promotional bank) all 17 Sustainable Development Goals of the United Nations (for more information, see www.kfw.de/sdgs).

To quantify KfW’s sustainable impact, an initial group-wide set of indicators was developed for all impact categories based on the KfW-wide ‘Theory of Change’. These will be successively expanded and developed. The impact indicators are identified by the individual business areas of KfW in accordance with their relevance and combined into a group-wide KfW impact balance sheet. The impact balance sheet is initially intended for internal reporting but will also be published from 2022.

Impact indicators are clearly measurable, defined key figures agreed throughout KfW. These can be quantitative (e.g. number of jobs secured) or qualitative/quantitative (e.g. SME rate based on local/internal SME definition). The indicators can be measured at output, outcome or impact level depending on data availability and are thus to be interpreted in part as estimates for particular impact goals. Where possible, KfW’s impact indicators are based on internationally harmonised impact indicators IRIS+ (www.thegiin.org) or the Green Bond Principles (icmagroup.org) and can be assigned to the three dimensions of sustainability (environmental, economic, social) as well as the 17 SDGs.

A list of the first, group-wide set of impact indicators can be found in Appendix III of the methodology paper "KfW Group’s impact management".

Implementing impact management

In order to be able to collect and evaluate impact data automatically in the future, the IT implementation was started parallel to the technical project. The first important milestone was reached in March 2022 when the IT system went live. It is now possible to collect, analyze and report impact data.

Since going live, the IT system has been successively enhanced. As soon as all business areas are connected, it will be possible to report the Group-wide impact of KfW Group for the first time.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw.de/s/ennBiB2C

Copy link Link copied