Economic Outlook

Comments of KfW Research

06.02.2026 | Industrial production in Germany

“Today's slowdown in production follows three consecutive monthly increases. With an increase of 0.9 per cent compared to the third quarter, quarterly momentum remains strong. Together with the excellent order intake, which will only have an impact on production after a delay, the trend reversal in production in this country is likely to be completed soon. Overall, this is a solid foundation, perhaps even a springboard for growth in 2026."

Dr Sebastian Wanke

German Economy / European Economy

KfW Business Cycle Compass Germany / Eurozone

Economy in a standby position

26 November 2025

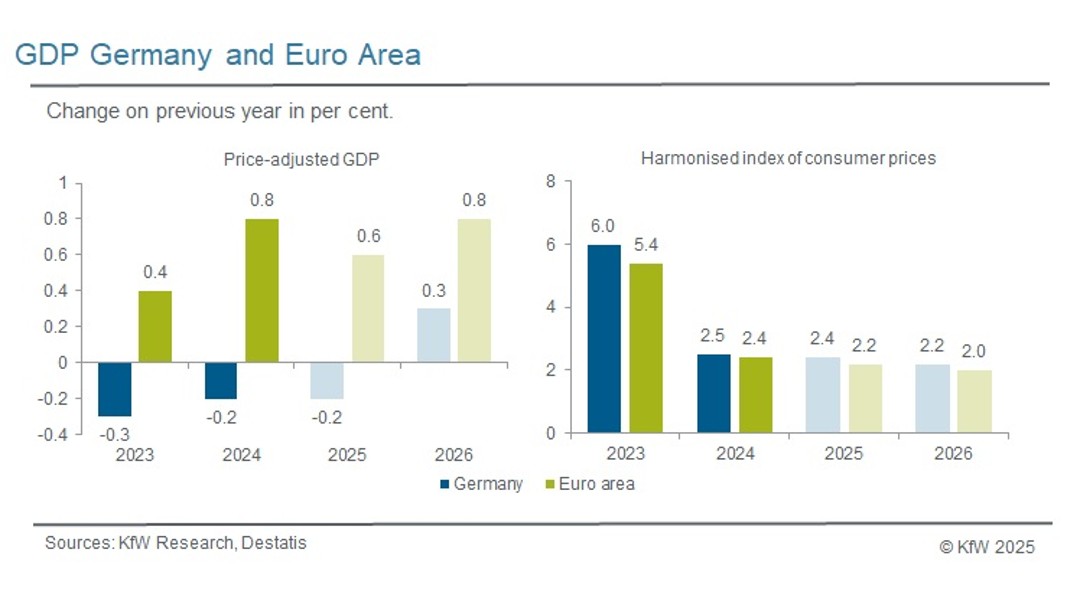

Although the upswing has not yet begun, the German economy is likely to now be in pole position. After two years of recession, moderate growth of +0.2% can be expected in 2025. It is then likely to even accelerate significantly in 2026, driven by rising government expenditure and an unusually large number of working days. Our growth forecasts for Germany for 2025 and 2026 remain unchanged at +0.2 and +1.5%. The economy in the euro area is growing at a robust pace despite the US tariffs which were increased in the spring. We have revised our forecast for 2025 upwards by 0.2 percentage points to 1.4%. We now expect slightly stronger growth of 1.3% in 2026 as well. Lower energy prices will keep the lid on price rises in 2026, particularly at the start of the year. We maintain our inflation forecasts for 2026 at 2.0% for Germany and 1.9% for the euro area.

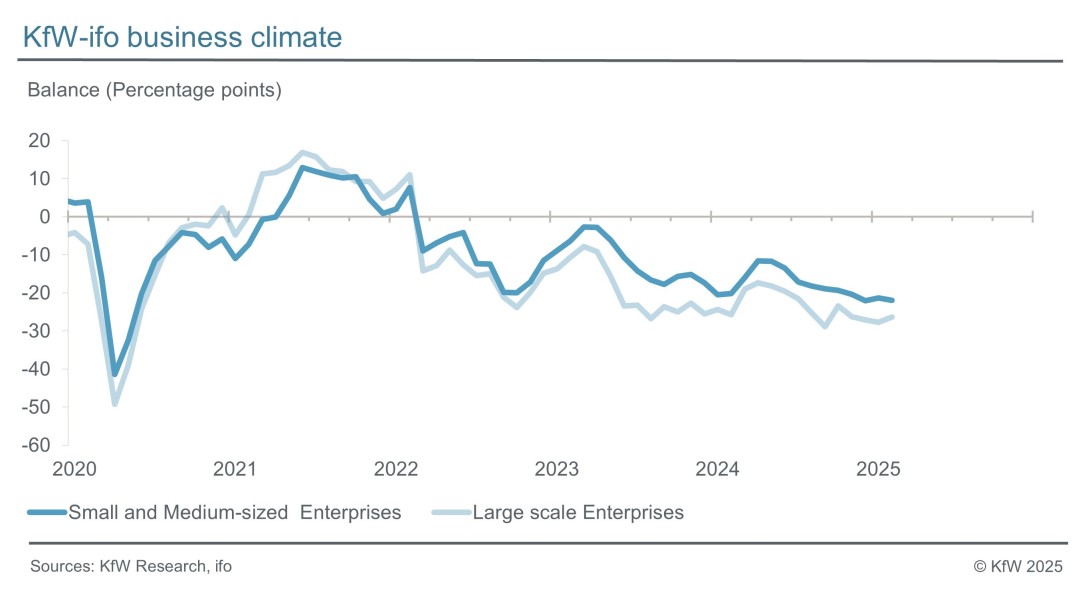

KfW-ifo SME Barometer

SMEs play a decisive role for the growth and prosperity of an economy. Using its unique surveys, studies and statistics, KfW Research analyses the needs of SMEs in Germany. The KfW-ifo SME Barometer indicators are based on a scale-of-enterprise evaluation of the ifo economic surveys, from which the well-known ifo business climate index is calculated, among others. Around 9,500 businesses, including around 8,000 SMES, from manufacturing, construction, wholesale, retail and services (excluding lending, insurance and state) are polled monthly regarding their economic situation.

Tougher than expected

30 January 2026

In January SME business sentiment edged down slightly by 0.1 points to -15.0 points. Businesses viewed their situation slightly more positively but in return their expectations fell. With that, SME sentiment generally defied the most recent Greenland turmoil. This time, however, the really good news is in the details.

Contact

KfW Research, KfW Group, Palmengartenstrasse 5-9, 60325 Frankfurt, Germany,

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw.de/s/enkBbw3W

Copy link Link copied