KfW Research - Dossier

Venture CapitalFinancing with venture capital creates a key requirement for start-ups to be able to open up markets and generate growth with new technologies and innovative business models. The venture capital market therefore plays an important role in the competitiveness of the economy. The German venture capital ecosystem has continued to mature in recent years but there is still a need to catch up in an international comparison. KfW Research analyses the German venture capital ecosystem and, in addition to topic-related publications, offers a quarterly barometer on business sentiment among German investors and a dashboard on the development of the German venture capital market.

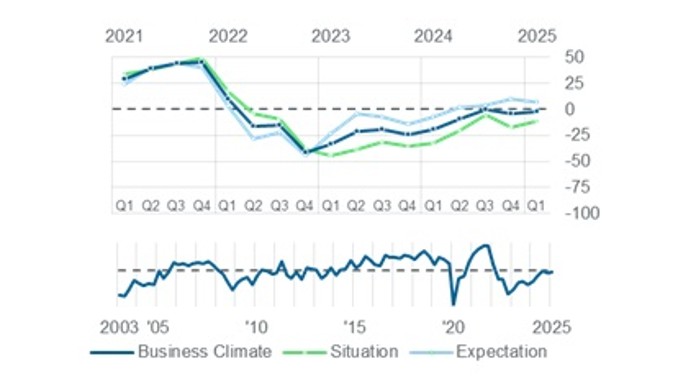

Sentiment in the German venture capital market dropped in early summer. The VC market sentiment indicator fell by 17 points to -18.8 balance points in the second quarter of 2025. Thus, it switched back to red after showing amber in the previous quarters, when everything was suggesting a new phase of green was coming soon. Business expectations have now deteriorated at an above-average rate.

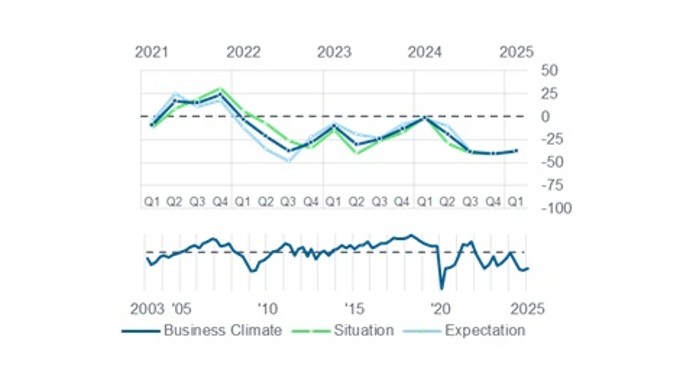

Sentiment in the German private equity market soared in early summer. The business climate indicator for the segment of the private equity capital market that targets investments in established enterprises rocketed by 33.3 points to -3.9 balance points and is now just slightly below its long-term average. That was the second highest rise of the indicator since measurements began. Current business situation assessments and business expectations have both improved massively. According to media reports, international capital investors intend to focus more on Europe as a result of US economic and fiscal policy. The hope that this will generate an influx of capital appears to be the driver of the broad sentiment improvement.

After a quiet first quarter, the German VC market picked up steam in the second quarter of 2025. In Q2 2025, German start-ups raised around EUR 2.4 billion in venture capital – significantly more than in the first quarter (+45% QoQ). The first half of 2025 thus closed with a deal volume of just under EUR 4 billion.

That means the German VC market posted a growth in deal volume for the third half-year in a row. The investments in Q2 2025 took place in 208 financing rounds thus far reported, 98 of which with an individual deal volume of over EUR 1 million.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw.de/s/enkBeJdc

Copy link Link copied