Tip: Activate javascript to be able to use all functions of our website

KfW Research - Dossier

Venture CapitalFinancing with venture capital creates a key requirement for start-ups to be able to open up markets and generate growth with new technologies and innovative business models. The venture capital market therefore plays an important role in the competitiveness of the economy. The German venture capital ecosystem has continued to mature in recent years but there is still a need to catch up in an international comparison. KfW Research analyses the German venture capital ecosystem and, in addition to topic-related publications, offers a quarterly barometer on business sentiment among German investors and a dashboard on the development of the German venture capital market.

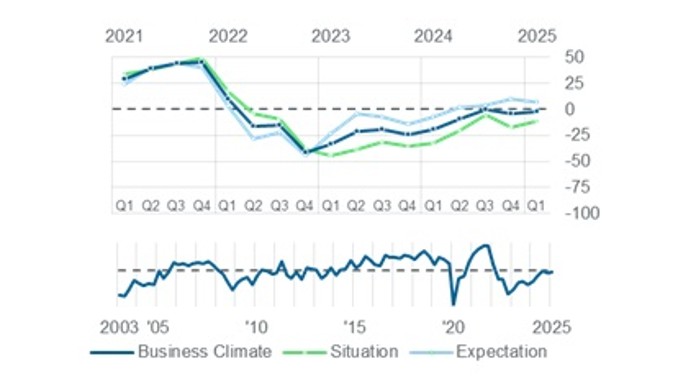

Sentiment in the German venture capital (VC) market dropped significantly in the final quarter of 2025. The sentiment indicator dropped sharply to -32.4 points. The indicator for the current business situation fell by 25.9 points to -37.5 points, while the indicator for expectations plunged by 38.9 points to -27.4 points. Thus, investor sentiment at the end of the year 2025 was only slightly above the five-year low at the end of 2022 following the rapid interest rate reversal to combat inflation. Compared with the almost steady sentiment recovery seen in the years 2022 to 2024, the levels of mood fluctuated wildly in 2025.

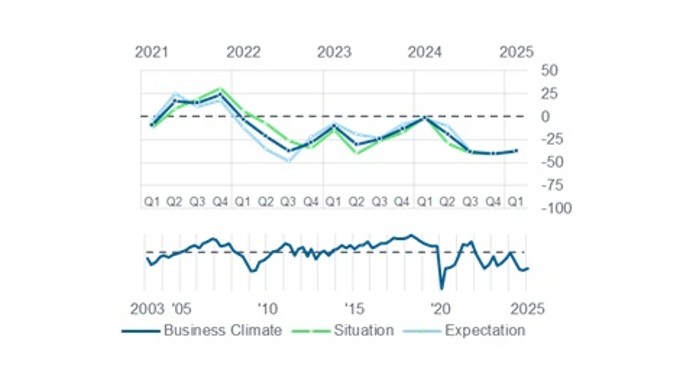

The mood among German private equity investors is brightening. The business climate indicator for the segment of the private equity capital market that targets investments in established enterprises surged by 20.0 points to -16.7 balance points in the fourth quarter of 2025. After the jump in confidence in the second quarter and the hard landing in the third quarter, the rollercoaster of emotions in the German private equity market thus continued up to the end of the year. The indicator for current business situation assessments increased by 29.5 points to -11.2 balance points, a steeper increase than the indicator for expectations, which climbed by 10.5 points to -22.1 balance points.

The German market for venture capital exhibited a sideways movement in 2025 against the backdrop of high overall economic uncertainty. In total, EUR 7.2 billion was invested in German start-ups (2024: EUR 7.5 billion; 2023: EUR 7.1 billion). The final quarter was the year’s second strongest with a deal volume of EUR 2 billion.

Share page

To share the content of this page with your network, click on one of the icons below.

Note on data protection: When you share content, your personal data is transferred to the selected network.

Data protection

Alternatively, you can also copy the short link: https://www.kfw.de/s/enkBeJdc

Copy link Link copied