Liquefied natural gas (LNG) has played a key role in Germany’s energy security since the Ukraine War. In the medium term, the import will replace Russian pipeline gas. On behalf of the German Federal Government, KfW is now participating in the construction of Germany’s first LNG terminal in Brunsbüttel.

Liquefied natural gas (LNG) has played a key role in Germany’s energy security since the Ukraine War. In the medium term, the import could replace Russian pipeline gas. On behalf of the German Federal Government, KfW is now participating in the construction of Germany’s first LNG terminal in Brunsbüttel.

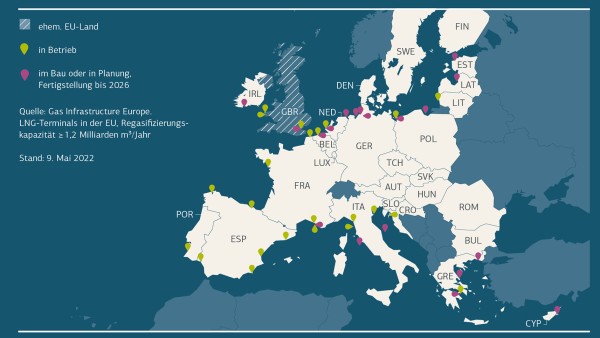

Pipeline or ship? This was not even a question until recently. The German Federal Government was not even considering a switch from pipeline gas to liquefied natural gas, which has to be imported using huge tankers. In a short study, the Federal Environment Agency concluded in 2019: “From a climate policy perspective and from an energy efficiency perspective, increased use of LNG is not justifiable, especially in comparison to gas transported by pipeline.” It is only logical then, that Germany does not yet have any import terminals for liquefied natural gas – unlike most EU coastal states (see map).

However, Russia’s attack on Ukraine on 24 February 2022 has abruptly changed the situation. At that time, Germany covered 55 per cent of its demand through Russian pipeline gas – a dependency that makes it susceptible to blackmail and forces Berlin to act.

A good two months after the start of the war, Minister for Economic Affairs Robert Habeck announced that the share had been reduced to 35 per cent. The aim is to eliminate dependency on the Russian supply as quickly as possible. Because the government is sticking to the phasing out of coal and nuclear power, and even an accelerated energy transition cannot end dependence on Russia in the short term, Berlin is relying on the development of infrastructure for LNG.

Pros and cons of the technology

LNG TERMINALS IN THE EU

More and more LNG terminals are being built on Europe’s coasts, in part to become more independent of Russian pipeline gas.

Liquefied natural gas, LNG, consists of around 98 per cent methane, is colourless, non-toxic and is produced when natural gas is cleaned of other substances and cooled to minus 162 degrees Celsius. As a liquid, the energy carrier takes up only one-hundredth of its gaseous volume and can therefore be transported in large quantities over long distances. There is no need to build long pipelines and no obligation to be bound to just one supplier in the long term. These are the major advantages of LNG over pipeline gas.

The disadvantage is that production consumes up to 25 per cent of its own calorific value. Long transport routes by ship are expensive and cause additional emissions. If the natural gas liquids originate from the USA or Australia – two of the world’s largest LNG exporters alongside Qatar – they are often obtained by fracking, a process in which methane escapes into the atmosphere and which is also controversial for other unpredictable long-term consequences for the environment. On top of that, there are further methane losses within the entire LNG process chain. And as a greenhouse gas, the impact of methane on the environment is 25 times that of CO2.

Why is Germany now building LNG terminals?

There is disagreement among experts whether the climate damage caused by natural gas use will be higher if LNG imports replace Russian pipeline gas in the future. However, there is widespread agreement that natural gas is the least harmful to the climate among all fossil fuels, regardless of whether it is liquid or gaseous. Even before the Ukraine war, it was clear that Germany was using natural gas as a bridge technology for the transition to renewable energies. This is because energy-intensive industry, in particular, which accounts for more than a third of German natural gas consumption, cannot replace natural gas on an ad hoc basis.

Previously shelved plans for German LNG terminals on land have now been dusted off again. Take Brunsbüttel, for example: it is Schleswig-Holstein’s largest connected industry and port location, strategically located at the mouth of the Kiel Canal into the Elbe. Even the largest tankers with up to 266,000 cubic metres of LNG on board can dock here. This is equivalent to almost 160 million cubic metres of pipeline gas – twelve such tankers would be sufficient to supply Hamburg with natural gas for one year.

Initial help from KfW

Most LNG deliveries are supplied under long-term contracts. In 2021, 73 per cent of all exports went to Asia, primarily China, where LNG is expected to accelerate the phase-out of coal. Germany is late to the table and has many rivals in the competition for liquefied natural gas. Therefore, the construction of the LNG terminal in Brunsbüttel is now set to proceed quickly. “Without long-term contracts, however, financing is not possible,” says Michael Kleemiß, Managing Director of the German LNG Terminals GmbH consortium, which was founded in Brunsbüttel in 2018 to promote the construction of an LNG terminal. Planned regasification capacity: eight billion cubic metres per annum. KfW will join the consortium on behalf of the Federal Government as a member and acquire a 50 per cent stake. “This investment reduces dependence on Russian pipeline gas and at the same time ensures security of supply,” says Felix Freitag, Head of Strategic Investments at KfW. “LNG is seen as a bridge technology in the transformation to the desired greenhouse gas neutrality by 2045. Therefore, the continued use of the terminal for importing hydrogen derivatives is also being taken into account from the outset when planning the terminal.” Other participants include the German energy company RWE with ten per cent and the Dutch gas network operator Gasunie with 40 per cent. Kleemiß explains the distribution of roles: “Gasunie was involved right from the start, is heavily involved in the development and will ultimately also become the operator of the LNG terminal.”

How does LNG enter our gas network?

LNG TERMINAL

Liquefied natural gas is supplied in tankers and stored at the terminal. It can be transported on in liquid form or fed into the long-distance gas network in gaseous form by means of exhaust heat from adjacent industry.

A terminal with two jetties is planned. LNG carriers dock there with liquefied natural gas from exporting countries such as Qatar, the USA, Nigeria and Algeria.

The large Q-Max tankers on Jetty 1 can be processed in about 20 hours; Jetty 2 is intended for smaller bunker vessels. Pipelines carry the LNG in liquid form to two tanks, each of which can temporarily store 165,000 cubic metres of LNG. From there, the LNG is redistributed.

Part of it continues its journey in liquid form by bunker ship, tanker or rail tanker to filling stations for LNG-powered trucks or for refuelling ships in German ports. The other part is regasified, i.e. heated and compressed. Industrial exhaust heat can be used for this purpose. The gas is then fed into the German transmission network via a roughly 65-kilometre-long pipeline.

Rapid development of LNG infrastructure

The terminal in Brunsbüttel is expected to be operational by 2026 at the latest. To get there, of course, there is a permit timetable to follow, says Michael Kleemiß, “In total, three different permits must be obtained: by us for the port facilities and the terminal, and also for the pipeline to the gas network by its operators.” The project currently has political support. With a legal amendment, the Schleswig-Holstein State Parliament has made it possible for construction to continue on the terminal even if courts still have to decide on any legal action. And it is more than likely that complaints will be received.

Several environmental associations are critical of the project. They question the major investment in fossil fuels and consider the site unsuitable, not just because of the adjacent chemical park. A hazardous waste incineration plant and the decommissioned Brunsbüttel nuclear power plant with interim storage for radioactive waste are located in the immediate vicinity. According to the relevant land-use plan, the establishment of another hazardous incident plant is prohibited.

FLOATING LNG TERMINALS

The 'Höegh Esperanza' is one of a total of four FSRUs (Floating Storage and Regasification Unit), which have already been rented on behalf of the German Federal Government from RWE and Uniper to supply LNG to the German natural gas grid from winter 2022/23.

However, even if approval and construction can be accelerated in Brunsbüttel and Wilhelmshaven in Lower Saxony, the second planned location for a German LNG terminal, this does not offer supply security for the coming winter. This is why the Federal Government has now chartered four floating terminals as a quick solution. The principle is the same as on land: LNG arrives in tankers, is stored and redistributed in liquid form by ship or regasified via pipeline. The Federal Government is providing just under three billion euros for this purpose.

Construction work has already begun in Wilhelmshaven. Economic Affairs Minister Robert Habeck watched the first pile being driven, comparable to a ground-breaking ceremony on land, for the liquid gas terminal jetty from a ship. “We have a good chance to create what seems actually impossible in Germany: to build an LNG terminal within around ten months and connect it to the German gas supply.”

Fossil-free in the future

Germany wants to convert its energy system to renewable sources by 2045 at the latest. This will put an end to fossil fuels. In Brunsbüttel and Stade, this is even viewed as an opportunity as the plants can regasify both LNG of fossil origin and bio-LNG from organic residues and synthetic LNG, which is extracted in power-to-gas plants with green electricity. “Whether from biomass, electrolysis or fossil fuels, the main component is always methane,” says Toni Reinholz, explaining the composition of the energy source. Reinholz is an expert in renewable energies at the German Energy Agency (dena) and considers the German terminals to be absolutely necessary. “We will continue to need significant amounts of gas in the near future.”

He predicts that methane-based energy sources will dominate in the short and medium term. In the long term, it can be expected that green hydrogen and its derivatives will replace LNG. Which is why the plants in Brunsbüttel and Wilhelmshaven are already being planned in such a way that they can also be converted for the import of green hydrogen and its derivatives.

Published on KfW Stories on 1 July 2022

The described project contributes to the following United Nationsʼ Sustainable Development Goals

Goal 9: Build resilient infrastructure, promote sustainable industrialization and foster innovation

Non-existent or dilapidated infrastructure hinders economic efficiency and thus engenders poverty. When building infrastructure, the focus should be on sustainability, for example, by promoting environmentally-friendly means of transport. Factories and industrial facilities should also ensure that production is in line with ecological aspects to avoid unnecessary environmental pollution.

All United Nations member states adopted the 2030 Agenda in 2015. At its heart is a list of 17 goals for sustainable development, known as the Sustainable Development Goals (SDGs). Our world should become a place where people are able to live in peace with each other in ways that are ecologically compatible, socially just, and economically effective.

_rs_cta_teaser_3_small.jpg)

Data protection principles

If you click on one of the following icons, your data will be sent to the corresponding social network.

Privacy information